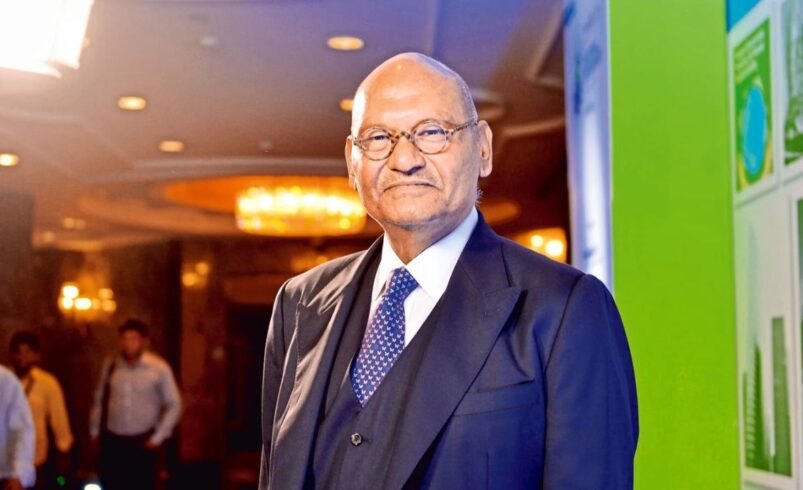

While political tensions between the US and China dominate global headlines, Vedanta Chairperson Anil Agarwal highlights a different frontline in the global trade war—metals. According to him, steel and aluminium are no longer just industrial commodities, but critical tools in international economic strategy. As India steps up by imposing a 12% safeguard duty on steel imports to protect its domestic market, Agarwal sees this move as both necessary and overdue. However, he warns that aluminium is the next major target. The trade war is reshaping supply chains and dumping patterns, and India must be proactive in shielding its metal industry from being overwhelmed by surplus global inventory, especially from manufacturing powerhouses like China.

India’s Steel Safeguard Duty: A Timely Shield for Local Producers

In April 2025, India implemented a temporary 12% safeguard duty on select steel imports for 200 days, aiming to curb the inflow of cheap foreign steel that threatens to destabilize the domestic market. The duty is targeted at steel priced below global benchmark rates, providing a much-needed breather for local manufacturers who have long demanded protection against unfair competition. Agarwal welcomed the move, viewing it as a strong signal that the government is willing to act in national economic interest. This decision aligns with the global trend where countries, including the US, have implemented similar protective measures. For India, which is rapidly expanding its infrastructure and industrial base, shielding its steel sector is critical to sustaining growth and employment.

Aluminium Under Pressure: Why India Must Act Now

Agarwal’s warning about aluminium is rooted in the strategic importance of the metal and the vulnerability of India’s market. Aluminium is lightweight, highly recyclable, and essential across industries—from aerospace to consumer electronics. With global players like China facing export restrictions in the West, there is a rising threat of cheap aluminium being dumped in India and other emerging markets. Agarwal stressed that countries losing traditional buyers will aggressively seek new markets, and India—with its expanding demand—is an obvious target. If the government does not move quickly to apply similar safeguard duties on aluminium, the domestic industry could face severe financial pressure, job losses, and stunted growth in downstream sectors.

India’s Bauxite Advantage: A Golden Opportunity at Risk

India holds vast bauxite reserves—the primary raw material for aluminium—and Agarwal sees this as a strategic advantage that must be leveraged responsibly. With the right policy support, he believes India can position itself as a global aluminium hub, not just in raw production but also in developing a robust downstream ecosystem of fabrication, alloy manufacturing, and exports. However, this vision can only be realized if local industries are protected from price wars caused by dumped imports. The aluminium sector can create thousands of jobs, attract global investment, and boost export potential—provided the government acts decisively. Failure to intervene in time could allow foreign players to cripple India’s emerging edge through market saturation.

Trade Policy as Economic Defense: A New Era of Strategic Protectionism

Agarwal’s message is clear: safeguard duties are not merely trade tools, but essential defenses in an increasingly hostile global economic environment. With examples from the US—where tariffs on steel and aluminium apply even to close allies like Canada and Mexico—he argues that India must shed hesitance and adopt a bolder, more strategic trade posture. As global power dynamics shift and economic nationalism rises, countries that fail to protect their industries risk long-term dependency and economic vulnerability. For India, the future of its metals sector lies in timely, well-targeted policy moves that ensure both growth and self-reliance. Aluminium might be next in line—but with vision and urgency, India can turn a threat into an opportunity.

Get the latest in business, markets, startups, and policy—visit businessnewsindia.in for in-depth updates and follow us on Instagram @businessnewsindia.in for daily bites of what matters most.

Source : businesstoday.in